These regulations which are essentially unchanged from the much maligned proposed regulations first issued in 2007 govern trust and estate costs subject to the 2 percent floor on miscellaneous itemized deductions.

Deductions subject to 2 floor for estate.

This publication covers the following topics.

However deductions under section 67 e 1 continue to be deductible if they are costs that are incurred in connection with the administration of an estate or a non grantor trust that would not have been incurred if the property were.

Report other miscellaneous itemized deductions on form 1041.

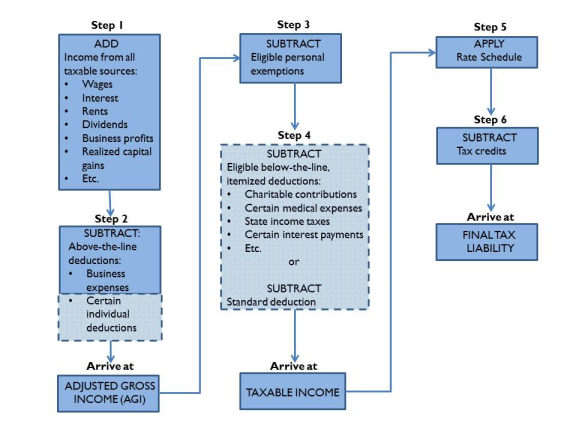

Under knight fees paid to an investment adviser by a nongrantor trust or estate are generally miscellaneous itemized deductions subject to a floor of 2 of adjusted gross income agi rather than fully deductible as an expense of administering an estate or trust under sec.

When filing form 1040 or form 1041 for a decedent estate or trust you must determine how to deduct administration fees.

You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr.

The supreme court held that the latter provision limits its.

The regulations apply to tax years beginning on or after jan.

67 g generally provides that miscellaneous itemized deductions subject to the 2 percent of adjusted gross income floor are suspended and may not be deducted for tax years beginning after 2017 and before 2026.

As added by the tax cuts and jobs act tcja p l.

Accordingly we conclude that the investment advisory fees incurred by the trust are subject to the 2 floor thus the 2 percent floor for estate or trust itemized deductions applies notwithstanding that the personal representative or trustee who may be held to the uniform prudent investors act may believe that the 2 percent floor does.

Deductions for attorney accountant and preparer fees are limited on schedule a of form 1040.

Miscellaneous itemized deductions subject to the 2 floor aren t deductible for tax years 2018 through 2025.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation.

Examples of itemized deductions not subject to the 2 floor include costs related to fiduciary income tax returns.