Expected life of carpet.

Depreciated value carpet.

Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.

Residential rental property is depreciated at a rate of 3 636 each year for 27 5 years.

Every year you take a write off for the amount that you.

10 years 8 years 2 years.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

Original cost of carpet.

100 per year age of carpet.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

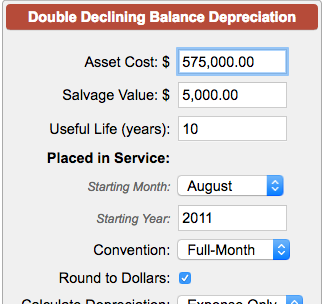

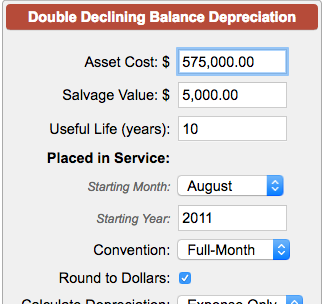

Most types of flooring and other capital assets get depreciated by dividing their value by a set number of years called a recovery period.

Beyond that distinction depreciating carpeting is the same as depreciating a new appliance see the more detailed appliance depreciation article above.

Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years.

By convention most u s.

10 years depreciation charge 1 000 10.

2 years 100 per year 200.

Most other types of flooring i e.

Carpets are normally depreciated over 5 years this applies however only to carpets that are tacked down.

You cannot depreciate land.

Value of 2 years carpet life remaining.

Normal wear and tear.